You can assign a nickname to all NAB accounts except NAB Traveller Card, NAB General Insurance accounts, Equity Lending Facilities, and nab-trade accounts.ġ. The nickname you choose is only used within NAB Internet Banking and doesn't affect the name of the account as it appears in the documentation that you receive from NAB (for example, statements and cheque books). Giving an account a nickname makes it easier for you to recognise each of your accounts. Payments made after 6pm on business days, or at any time on a weekend or public holiday will usually be treated as being received by the biller on the next business day.įor more detail check out our different cut-off and processing times table. If you make a BPAY ® payment before 6pm (Melbourne time) on a business day, we’ll send the details to the biller’s bank on the same day. If it's after 10pm, or on a weekend or public holiday, the next business day. If you make the payment before 10pm (Melbourne time) on a business day in most cases they'll receive the funds on the same day. If you make the transfer before 6pm (Melbourne time) on a business day in most cases they’ll get the funds the next business day, and if it’s after 6pm, or on a weekend or public holiday, within two business days. Transfer to another financial institution When paying to a PayID, in most cases they’ll have the funds in under 60 seconds. Transfer using PayID or to your linked accounts Bill payments to BPAY ® billers who have been bank authorised (individual billers may impose their own transaction limits).Funds transfers between your linked accounts at NAB.There’s a separate daily limit for international funds transfers.

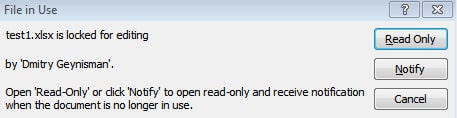

#EXCEL FILE LOCKED FOR EDITING NETWORK PLUS#

International funds transfers (both the transaction amount in AUD dollars plus the international funds transfer fee).BPAY ® payments (for bill payments made to non NAB authorised billers by customers who are not registered for SMS Security).multiple funds transfers from your linked accounts to other financial institutions and other NAB accounts not linked to you.funds transfers from your linked accounts to other financial institutions or other NAB accounts not linked to you.By being registered for SMS security you can change your daily transfer limit up to $40,000 1 by selecting the Profile & Settings menu and then Internet Banking Settings. The default limit is $2,500 if you’re not registered for SMS security or $5,000 if you’re registered for SMS security.

0 kommentar(er)

0 kommentar(er)